Bitcoin (BTC) broke below a short-term uptrend as momentum signals turned negative. The cryptocurrency could see further declines towards $30,000, which is near the bottom of a one-year trading range.

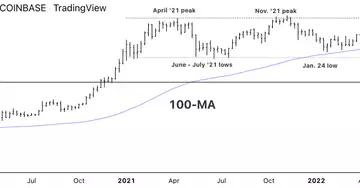

BTC has failed to hold at $40,000 in recent months and is down 47% from its all-time high at $69,000 last November. The long-term uptrend has weakened, suggesting that upside potential remains limited this year.

On the weekly chart, there is a risk of BTC falling below its 100-week moving average at $36,247. A second weekly close below this level could lead to downside targets towards $30,000 and then $17,823 (a decline of about 80% from peak to trough, comparable to the 2018 crypto bear market).

That said, May is typically a seasonally strong period for stocks and cryptocurrencies. This could lead short-term buyers to remain active at lower support levels, even if they lack conviction to change the recent downtrend in price.