Crypto funds' assets under management fell to their lowest level since July 2021 last week due to the recent drop in cryptocurrency and stock market prices, triggered in part by the U.S. Federal Reserve's move to reduce its balance sheet starting next month.

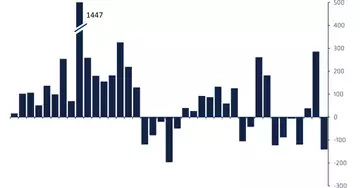

CoinShares reported that the value of digital asset funds' assets under management fell to $38 billion as investors withdrew about $143 million in the week ended May 20. This was the second largest outflow this year.

"Confidence in cryptocurrencies has faltered as both retail and institutional investors who invested in cryptocurrencies last year are deep in the red," said Edward Moya, senior market analyst at trading platform Oanda.

It was a wild shift from sentiment just two weeks ago, when investor inflows surged to a 2022 high as they appeared to be buying the market dip amid the implosion of the Terra blockchain's LUNA token and its UST stablecoin.

Bitcoin (BTC), the largest cryptocurrency, plunged as low as $25,892 in the week of May 9, its lowest level since December 2020. Since then, Bitcoin has recovered somewhat and stabilized around the $30,000 mark. At press time, it was changing hands at $30,223.

Investors diversify from bitcoin

Bitcoin-focused funds suffered the lion's share of outflows, with $154 million in outflows last week, accounting for about half of the $299 million in inflows the previous week.

Funds managed by Purpose, a fund provider that manages the largest bitcoin exchange-traded fund in North America, saw $150 million in outflows.

About $154 million flowed out of North American crypto funds, while funds listed in Europe brought in $12 million.

On a positive note, multi-asset funds, i.e. funds holding multiple cryptocurrencies, saw inflows of $9.7 million last week. These types of funds may be the winners in crypto market volatility as investors seek to diversify their holdings, with $185 million in inflows year-to-date.

"We believe investors view multi-asset investment products as safer than single-line investment products in volatile times," James Butterfill, CoinShares head of research, said in a note.

Funds focused on altcoins - other cryptocurrencies beyond Bitcoin - did not see significant inflows in either direction. Funds involving Polkadot's DOT and Cardano's ADA were the biggest winners, with $1 million in inflows each.