Bitcoin (BTC) is showing signs of life after nine consecutive weeks of losses. It seems that extreme bearish sentiment and oversold signals have encouraged some buyers to return from the sidelines.

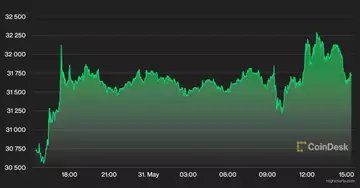

Most of the relief in BTC was seen on Sunday, when the cryptocurrency surged above $30,000. The weekend price jump was bitcoin's biggest one-day gain since March, with the price rising 7.8%, according to Arcane Research.

Meanwhile, most alternative cryptocurrencies (altcoins) underperformed Bitcoin on Tuesday, suggesting traders are still unwilling to take on additional risk. Bitcoin's market capitalization relative to the total market capitalization of cryptocurrencies rose over the past three days after breaking a year-long downtrend on May 13. Typically, alts underperform BTC in down markets due to their higher risk profile.

Just launched! Please sign up for our daily Market Wrap newsletter, which explains what's happening in the crypto markets - and why.

Still, some altcoins rallied on Tuesday as bearish sentiment began to fade. For example, Cardano's ADA token and Axie Infinity's AXS token rose by as much as 15% in the last 24 hours, while BTC gained 4% in the same period.

In contrast, Avalanche's AVAX token fell 3% on Tuesday, and Monero's XMR token dropped 4%. Overall, trading conditions for cryptocurrencies and stocks remain choppy despite the current pause in risk reduction.

Latest prices

●Bitcoin (BTC): $31,664, +3.46%.

●Ether (ETH): $1,938, +1.16%

●S&P 500 daily close: 4.132, -0.63%

●Gold: $1,840 per troy ounce, -0.64%

●Ten-year Treasury yield daily close: 2.84%.

Bitcoin, ether, and gold prices are determined at approximately 4 p.m. New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk indices can be found at coindesk.com/indices.

Short-Squeeze

On Sunday, the rise in BTC's price triggered a surge in short liquidations, which was the largest since May 11. This could be due to a short squeeze, where traders who have been shorting BTC liquidate their positions after an unexpected price increase.

Liquidations occur when an exchange forcibly closes a trader's leveraged position as a safety mechanism because the trader has lost some or all of its initial margin. This occurs primarily in futures trading.

Oversold bounce

Bitcoin and other cryptocurrencies appear to be heavily oversold according to some indicators.

The chart below shows MRB Partners' cyclical momentum indicator, which is the most oversold since the 2018 crypto bear market. This could indicate a short-term bounce in all cryptocurrencies.

Still, momentum indicators can remain in oversold territory while prices are in a downtrend. Occasionally, a breach of oversold thresholds may confirm an uptrend in prices, similar to the end of previous bear markets. This trend could last a few weeks.

Some analysts are skeptical of the recent rise in prices. "While it is plausible that BTC can continue its reversal after showing its first green weekly candle in 10 weeks, the ongoing macroeconomic headwinds make us cautious in the near term," FundStrat wrote in an email.

MRB released a report last week discussing several macroeconomic factors that could weigh on the bitcoin price despite oversold readings. For example, the sell-off in BTC since last November has coincided with tightening liquidity conditions, a decline in global negative-yielding bonds and a drop in cash held in money market funds and savings deposits - a complete reversal of the boom years for cryptocurrencies and equities.

Altcoin Review

- ADA pumps: the Cardano blockchain's native token rose on Tuesday, while other major altcoins rose in lockstep with bitcoin. Fundamental catalysts include a surge in native asset issuance on the network and the upcoming Vasil hardfork, a network upgrade expected in June that would increase scaling opportunities. Upside potential for further recovery appears limited as ADA faces strong resistance at 80 cents. Read more here.

- Record inflows for Algorand funds: Mutual funds managing ALGO, the token of the Algorand network, saw $20 million in inflows in the week ending May 27, CoinShares reports. The record weekly inflow was likely triggered by the launch of new products for the decentralized financial protocol (DeFi), which partnered with the world soccer governing body FIFA this month. Multi-asset funds, funds that manage more than one cryptocurrency, continued their streak of inflows, recording inflows totaling $191 million year-to-date. Read more here.

- New LUNA surges after a sharp drop: Terra's new LUNA token surged as much as 40% within 24 hours of its listing on crypto exchange Binance, attracting more than $850 million in trading volume. This came after the token fell 80% after its launch on Saturday, showing that trading LUNA is highly speculative as traders assess Terra's future. The new Luna tokens are part of an effort to revive the Terra blockchain after the collapse of its UST stablecoin and its twin token, which has been renamed Luna Classic (LUNC). Read more here.

Relevant Insights

- Morgan Stanley says record investment in crypto venture capital will slow: Deal activity peaked in December and could decline by as much as 50% by the end of the year, the bank said.

- Fidelity Digital Assets plans to double its headcount this year: the company plans to hire 110 people in technical roles, including engineers and developers with blockchain experience.

- Fireblocks is hiring former Bank of England fintech chief to lead CBDC efforts: Varun Paul will also work with market infrastructure institutions to explore the benefits of supporting digital assets and participating in DeFi.

- UK government proposes protections for stablecoin after Terra collapse: The measure would give the Bank of England more power over failed stablecoin issuers.

- CoinShares' Losses From Terra's Slide Hit $21.4M: Liquidating the digital asset firm's position was a "humbling lesson," the CEO said.

- Singapore Examines Crypto Use Cases With DBS, JPMorgan And Marketnode: In the first phase of the project, the Central Bank of Singapore is examining DeFi applications in wholesale funding markets.

- Terra's Mirror protocol reportedly suffers new security vulnerability: Community users raise the alarm about a possible flaw in LUNC price oracles.

- Polkadot's Moonbeam adds liquid staking giant Lido: Integration made possible by staking specialist MixBytes.

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Biggest gains

| Asset | Ticker | Returns | DACS sector |

|---|---|---|---|

| Cardano | ADA | +12.8% | Smart contracts platform |

| Stellar | XLM | +7.8% | Smart contract platform |

| Internet Computer | ICP | +6.4% | Data processing |

Biggest losers

| Asset | Ticker | Earnings | DACS Sector |

|---|---|---|---|

| Ethereum Classic | ETC | -2.0% | Smart contracts platform |

| Cosmos | ATOM | -0.5% | Smart contracts platform |

| EOS | EOS | -0.3% | Smart contract platform |

Sector classifications are provided through the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.