After a more than 50% drop in the price of major cryptocurrencies and the collapse of some major financial experiments, public opinion about cryptocurrencies has predictably turned 180 degrees. It happens every few years: a crypto price bubble attracts a new wave of speculators, many of whom get burned after making bad bets on a technology they don't fully understand, and sentiment flips hard the other way. We've gone from the era of Davey Day traders doing cute things with Dogecoin to surgeons in Massachusetts losing their life savings with Luna.

It's true that blue-chip tech stocks like Meta and Netflix have lost almost as much as BTC in dollar terms over the past year, but we'll leave that aside. The crypto backlash is here, and it's taking extremely familiar forms. Jackson Palmer, who originally created Dogecoin as a performance art critique of cryptocurrency, is making a new round of skeptical statements. Molly White, founder of the anti-crypto blog Web3 is going just great, is profiled in the Washington Post. The skeptical "Crypto Critic's Corner" is suddenly one of the best technology podcasts in the world.

And that's good for all these largely constructive and incisive critics. A healthy presence of informed critical voices is a plus, not a minus, for any serious emerging technology sector. But the broader backlash will produce much more troubling nonsense, including a range of evasions and misrepresentations.

Chelsea Manning provided an excellent example in an interview published Tuesday, in which she awkwardly skirted the word "cryptocurrency" when describing her work for a project called Nym. Manning described herself as a "crypto-skeptic" and tried to explain why her project, which uses a blockchain to supposedly maintain privacy, is not part of that industry. But Nym has a token ... that incentivizes network maintainers ... and, look, it's a cryptocurrency! Chelsea Manning is helping to create a cryptocurrency, and that's a good thing!

Manning is a privacy and democracy advocate, a person we should all look up to for a few reasons, and it's heartbreaking that she feels the need to make this cryptoskeptic kabuki while accepting checks from a crypto startup. Also, the idea behind the Nym project seems .... questionable. If you're trying to protect citizens from government surveillance, a blockchain might not be the right place to start. Sorry.

Being called a cryptocurrency by a renowned privacy advocate who introduces a dubious token project? That's the very definition of "poorly done." And the wave of smug skeptics isn't going to subside anytime soon, in part because this crash has clearly found its villain and scapegoat in the form of Do Kwon, whose $68 billion stablecoin pair Luna/TerraUSD imploded like a pair of retreating testicles in early April. I say "villain" and "scapegoat" because he will be remembered, not because he triggered the general market crash (he kind of might have.), but because he and his work epitomize the worst excesses of the various failures, improvisers, hypebeasts and charlatans who made the crash possible.

In years past, that "dunk tanker" might have been Mark Karpeles of Mt. Gox or Gerald Cotten of QuadrigaCX, but this time, after cryptocurrency has reached a level of public attention it has never seen before, it is Do Kwon. He will be all over television for months. Having such a living embodiment of selfishness, venality, ruthlessness, and stupidity representing the entire crypto economy will make things measurably worse for the industry. (And you should definitely be mad at him, not just for that, but for everything else).

It's going to be a tough time, and no one knows how tough or for how long. Many of us have seen this show before. There are variations, but the crypto-retrace cycle has repeated itself four or five times now. Each time, the same behaviors occur as Krypto goes from mania of the month to whipping boy. The good news is that the receding tide also presents opportunities.

Blockchain, not crypto." Bear Market Scare

But the thing is, people will continue to enjoy taking investors' money. Given signals like Andreessen Horowitz's new $4.5 billion crypto investment fund, there could still be a decent amount of capital on offer even if public opinion of crypto is in the tank. So you'll hear a lot of griping and double talk like Manning's as people who still want the sweet, sweet cryptocurrency try to downplay their actual crypto activity.

Manning's dodge is a close relative of the best ever in this category, the argument for "blockchain, not crypto." This is a meaningless concept, since tokens with economic value are fundamental to the design of distributed public blockchains, at least for now. But rhetorically, "blockchain, not crypto" is meant to signal that you want all the cool aspects of blockchain technology without the financial volatility.

"Blockchain, not crypto" has been a particularly attractive slogan for blockchain departments at large companies in previous economic downturns. Not coincidentally, one way to actually implement the hollow premise of "enterprise blockchain" is in tightly controlled private networks that have limited long-term promise but are not remotely comparable to the strange transformative implications of public blockchains. It's a rhetorical feint designed to fool people who sway with the winds of changing moods and don't actually understand cryptocurrencies.

Life in winter

Simply ignoring these cowardly contortionists is the first step to surviving in a crypto winter. Another good step is to try to understand what happened. Why did Terra collapse? Why did SOL drop 80%, but ETH only dropped 58%? There are actual reasons, and learning them now will help you be better prepared when the sentiment around cryptocurrencies tilts the other way and the next wave of impulsive swing-buyers rolls in.

Another simple task you may not want to hear is, "Stop day trading." There are still downside moves out there, and no one knows where the market will bottom. Save the capital you still have and focus on other things - especially participating in communities, actively using products, developing skills, and maybe even building something. Day trading is a sucker's game even in boom times, but in bear markets you should really leave it to the pros. Calling yourself a "sword" on Twitter is less funny when your formerly fun gambling addiction has actually left you penniless.

Spending that time learning is a path to not only minimum self-esteem (remember to shower more, too), but actual success. Even a level 1 crypto speculator learns a lot about the industry, and at this point in the industry's growth, that knowledge will be of value even during a crypto contraction. Prominent people in the industry will also become much more accessible in the coming months, so you can really lay some groundwork for a future career move.

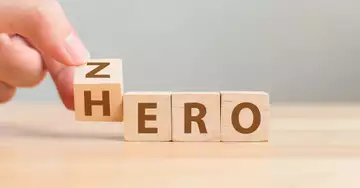

However, the most important tip for surviving the crypto backlash is simple: stick with it. The highly cyclical nature of cryptocurrency is its biggest annoyance and its biggest opportunity, as it provides new entry points for the dedicated while regularly flushing out the dilettantes. Whether you're a new crypto company employee wondering if it's time to ask Goldman Sachs for your job, or an ambitious newbie hoping for a breakthrough, the biggest mistake you can make is taking your eye off the ball. You never know which way it will bounce.